6 Fast Steps to Transfer Your Mobile Home Title in Pennsylvania

Transferring a mobile home title in Pennsylvania can seem daunting, but with the right steps, you can complete the process efficiently. Whether you’re a buyer or seller, ensuring proper documentation, verifying outstanding taxes, and resolving any liens are critical to avoid delays. This guide provides a detailed breakdown of each step involved, helping you navigate the title transfer process seamlessly.

Step 1: Check for Outstanding Taxes

One of the first and most important steps in transferring a mobile home title is to verify if any taxes are owed. This includes both county taxes and school taxes, which can cause complications if left unresolved.

For buyers, it’s essential to begin by obtaining the mobile home’s VIN or serial number. This number is required to verify the tax status of the property. Contact the local county tax office where the mobile home is located and request a valid clear tax certification. This document confirms there are no unpaid taxes associated with the property. If taxes are owed, they should typically be paid by the seller or deducted from the seller’s profit at closing. Buyers should also call the tax office ahead of time to confirm whether this process can be handled by just the buyer, just the seller, or if both parties need to be present.

Sellers must also take responsibility for verifying outstanding taxes before listing their mobile home for sale. By proactively obtaining the tax certification, sellers can streamline the process and avoid last-minute complications. Ensuring this step is completed beforehand demonstrates good faith and makes the transaction smoother for both parties.

Trouble with titles? We’re quite familiar!

We’ve been helping individuals and families handle their title issues when selling mobile homes for several years. Get a fast cash offer on your mobile home today anywhere in Pennsylvania.

Additionally, don’t overlook school taxes. Buyers and sellers should contact the local school district to confirm if back school taxes are owed. If you’re unsure which school district to contact, the county tax office can provide you with the appropriate information.

Step 2: Verify There Are No Hidden Liens

Hidden liens can present significant challenges during the title transfer process. These liens, which may not always appear on the title, can prevent the transfer of ownership until resolved. To avoid surprises, buyers and sellers should contact the Pennsylvania Department of Transportation (DOT) or a notary experienced in mobile home transactions. Provide them with the VIN or serial number to confirm the absence of any liens.

It’s not uncommon for liens to be missed during initial checks, as they may not always be listed in the “Lien Holder’s” section of the title. Taking this extra step ensures that all outstanding liens are identified and resolved, saving you time and potential legal complications.

Step 3: Special Considerations for Mobile Homes in Parks

If the mobile home is located within a mobile home park, additional steps may be required to complete the transaction. These steps ensure compliance with park rules and verify the financial standing of the seller:

- Speak with the park manager to determine if the buyer needs to meet any approval requirements to reside in the park.

- Verify that the seller is current on all lot rent payments and other fees owed to the park.

- Request a copy of the park rules to understand restrictions or guidelines that may affect your ownership.

- Inquire about any potential lot rent increases in the near future.

- Ask the manager if there are any necessary improvements required for the mobile home before or after purchase.

By addressing these considerations early, buyers can avoid unexpected fees or obligations after taking ownership of the mobile home.

We buy mobile homes in mobile home parks!

Moving out, selling your mobile home and having issues with titles or park management? We can help! Get a no-obligation cash offer today with zero hassles.

Step 4: Prepare for Closing

Closing is the most critical step in transferring ownership, and the required documentation will depend on whether you are completing the process yourself or using a notary or authorized agent.

If You’re Doing It Yourself

Buyers and sellers will need the following:

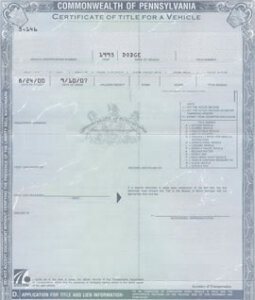

- The mobile home title(s) (one for each section; double-wide homes will have two titles).

- A clear tax certification obtained from the county tax office.

- A bill of sale, which can be handwritten or created using a template like the State Form MV-1.

Both parties should be present to sign and finalize the paperwork. While no notary is required for this process, ensure all forms are signed correctly to prevent issues at the Department of Transportation.

If You’re Using a Notary or Authorized Agent

Working with a notary, dealership, or messenger service that specializes in mobile home transactions simplifies the process. These professionals handle the paperwork and ensure compliance with state regulations. Both parties should appear together at the notary to complete the transaction. Alternatively, you can visit your local DOT office to finalize the transfer.

Pro Tip: Before handing over payment or signing the final documents, buyers should conduct a thorough walkthrough of the mobile home. Look for any surprise repairs, trash, or leftover furniture. If issues are found, negotiate a price adjustment with the seller before closing.

Step 5: Completing the Transfer After Closing

The title transfer process doesn’t end at closing. Whether you’re completing the process yourself or relying on a notary, there are additional steps to finalize ownership.

If Doing It Yourself

Bring the signed title(s), clear tax certification, and bill of sale to your local DOT office. While only the buyer is required to be present, having both parties attend can help resolve any last-minute issues. For a small fee, you can expedite the process and leave the DOT office with the new title in hand.

If Using a Notary

Notaries specializing in mobile home transactions will manage the title transfer on your behalf. Both parties must still attend to complete the process.

Step 6: Understand Future Tax Responsibilities

For buyers, remember that you will begin receiving annual county tax bills after the purchase. Keep your contact information updated with the tax office to avoid missed payments.

For sellers, it’s wise to accompany the buyer to the DOT office to confirm the title is properly transferred. Failure to do so may result in taxes or liability remaining in your name, especially if the buyer delays the transfer. Protect yourself by ensuring this step is completed.

Pro Tip for a Hassle-Free Title Experience

Partnering with a notary experienced in mobile home transfers can save time and reduce the likelihood of errors. These professionals will walk you through the process and handle the paperwork, ensuring a smooth transaction for both parties.

Transferring a mobile home title in Pennsylvania doesn’t have to be complicated. By following these steps and ensuring all documentation is in order, you can complete the process quickly and efficiently. Whether you’re a buyer or seller, preparation is key to a successful transfer.